Bryce Gilmore Geometry Of Markets Pdf File

Bryce Gilmore Geometry Of Markets Pdf Converter. Free ebook download as Text File (.txt), PDF File (.pdf) or read book online for free. Liquid Market Definition. Bryce Gilmore Geometry Of Markets Pdf Writer From millions of real job salary data. Average salary is Detailed starting salary, median salary, pay scale, bonus data report. Created Date: 3:28:43 AM.

Bryce Gilmore Geometry Of Markets Pdf File Average ratng: 4,1/5 1976votes AN INTRODUCTION TO THE METHODS OF WD. By Bryce Gilmore - www.bryce-gilmore.com. Geometry of Markets I & II. Dynamic Time and Price Analysis of Market Trends. WaveTrader/CycleTrader Software. Download Sim City 4 Highly Compressed.

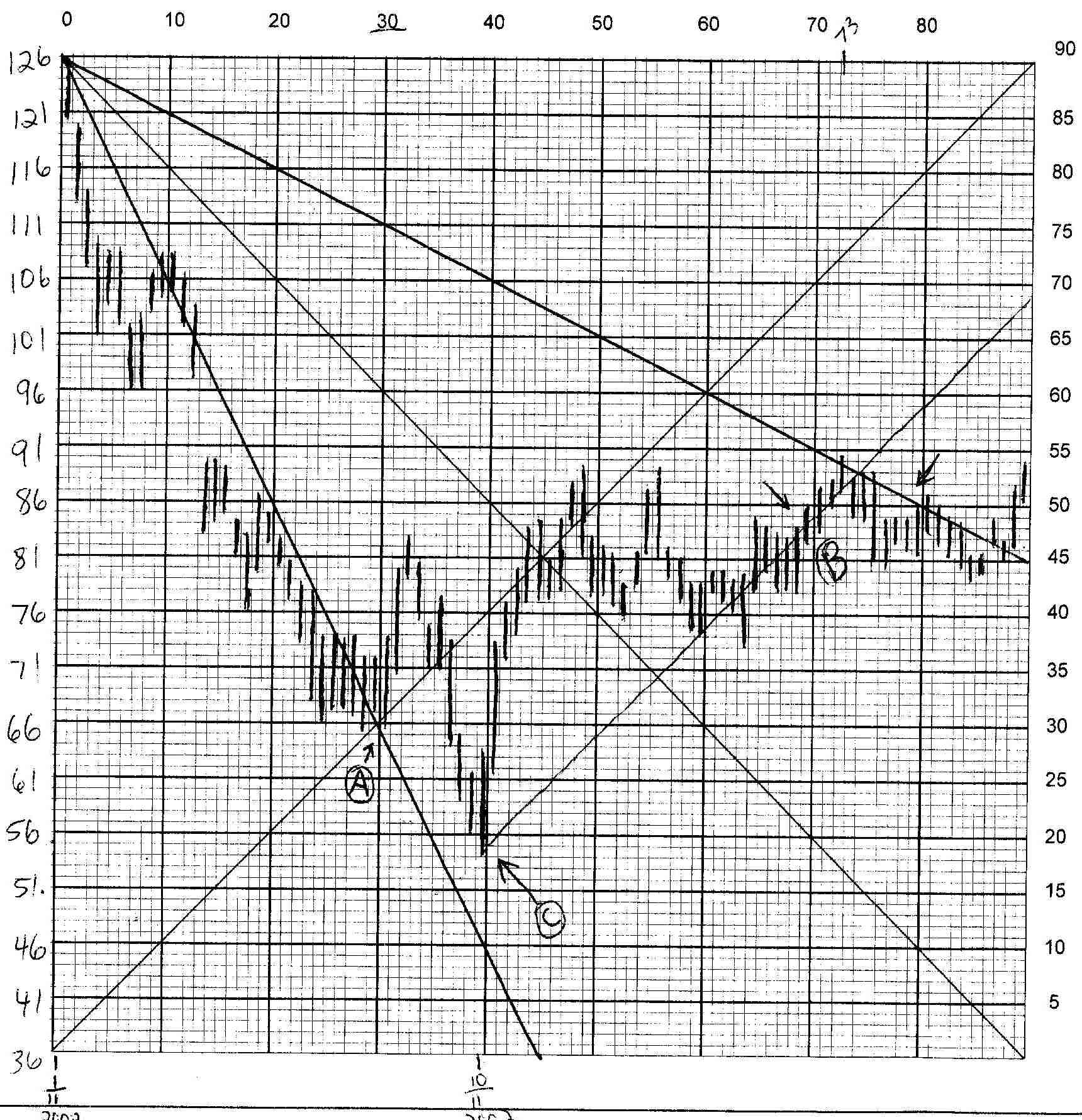

All the charts in this article were created using the WaveTrader/CycleTrader program. Traders Dynamic Index is a powerful weapon which every forex trader should have in his arsenal. TDI indicator is composed of 3 different indicators: Bollinger Bands.

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so. By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency,[1] and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year.[2] However, the U.S.

Dollar's status as a reserve currency, by increasing in value, hurts U.S. Exporters.[3] The Dutch guilder emerged as a de facto world currency in the 18th century due to unprecedented domination of trade by the Dutch East India Company.[4] However, the development of the modern concept of a reserve currency took place in the mid nineteenth century, with the introduction of national central banks and treasuries and an increasingly integrated global economy. By the 1860s, most industrialised countries had followed the lead of the United Kingdom and put their currency on to the gold standard. At that point the UK was the primary exporter of manufactured goods and services and over 60% of world trade was invoiced in pound sterling. British banks were also expanding overseas, London was the world centre for insurance and commodity markets and British capital was the leading source of foreign investment around the world; sterling soon became the standard currency used for international commercial transactions.[5] For example, suppose an American company sells electrical equipment to a buyer in France for one million euros. The equipment is to be delivered 90 days before the payment is made. At the time the sale agreement was made the exchange rate was $1.25 euros per dollar. Vmg Converter Cracked Screen.

This meant that the company was counting on receiving something in the neighborhood of $1.25 million in the transaction. Suppose the American company's cost for producing and delivering the equipment was $1.15 million and it was counting on making a $100,000 profit on the transaction. However if the value of the euro fell to $1.10 by the time the American company received payment then it would find that it had a $50,000 loss instead of a $100,000 profit. Suppose the American company required the French company to make the payment in dollars instead of euros. Then the French company would be bearing the risk. If the exchange rate fell from $1..

25 per euro to $1.10 then what it had been expecting to pay one million euros for would cost it about 1.136 million euros. One Exchange Transaction When converting all of a USD advance into one foreign currency, there will be just one transaction to document, one exchange rate to calculate and one exchange rate to be used throughout the reconciliation.